Are your estate documents stale? Are they still protecting you?

Estate Documents and Income Tax?

Make sure your estate documents are current. With the growing estate tax exclusion amount, this tax has been effectively repealed for about 99.8% of the country. However, there is another tax practitioners need to advise clients on: income tax. This means our strategies may need to adapt to meet our clients’ goals of avoiding or minimizing the amount of tax they pay the government.

Over the years, we have utilized irrevocable trusts, family LLCs, family partnerships, QPRTs and other techniques to minimize or eliminate estate tax for our clients. But, with the increased estate tax exemption and the potential of repeal on the horizon, now is the time to modernize those plans so that money is not needlessly wasted on income tax liability.

Consider this scenario:

Client had $1,000,000 of assets with $0.00 basis. The asset was transferred to an irrevocable trust in 1997, when the exemption amount was $600,000 and the estate tax rate was 55%. At the time, this saved Client $220,000. Over time, the assets have appreciated and today are worth $2,000,000. But, if Client died today, there would be no estate tax liability, even with the appreciation. However, by retaining the assets into an irrevocable trust as it’s currently structured, there is no step up in basis upon the death of Client. If the Trustee sells the assets today after the death of Client, the federal capital gain rate could be as high as 23.8% (20% long-term capital gain plus 3.8% net investment income), reducing the value of the assets by at least $476,000 and eliminating a significant fraction of the 20 years worth of appreciation. This doesn’t take into account state income taxes, which can be as high as 13.3%, depending on the state.

California Considers an Increase in Top Tax Rate.

Please note, several states including California are considering yet another increase to their top tax rate. Of even greater concern is that the new administration has floated several tax changes including a proposed increase of the federal capital gains rate to 43.8% on gains above $1,000,000. Further, this proposal would be retroactive to April 28, 2021.

Time to Re-evaluate Your Plan.

Bottom line: We must strategically evaluate existing irrevocable trusts, family LLCs, family partnerships, QPRTs, and other estate-tax driven strategies to ensure that they are still providing the best possible outcome for your clients. Of course, clients and their families stand to reduce taxes, but you stand to increase the assets under management and be the hero who connected them with a tax-saving solution.

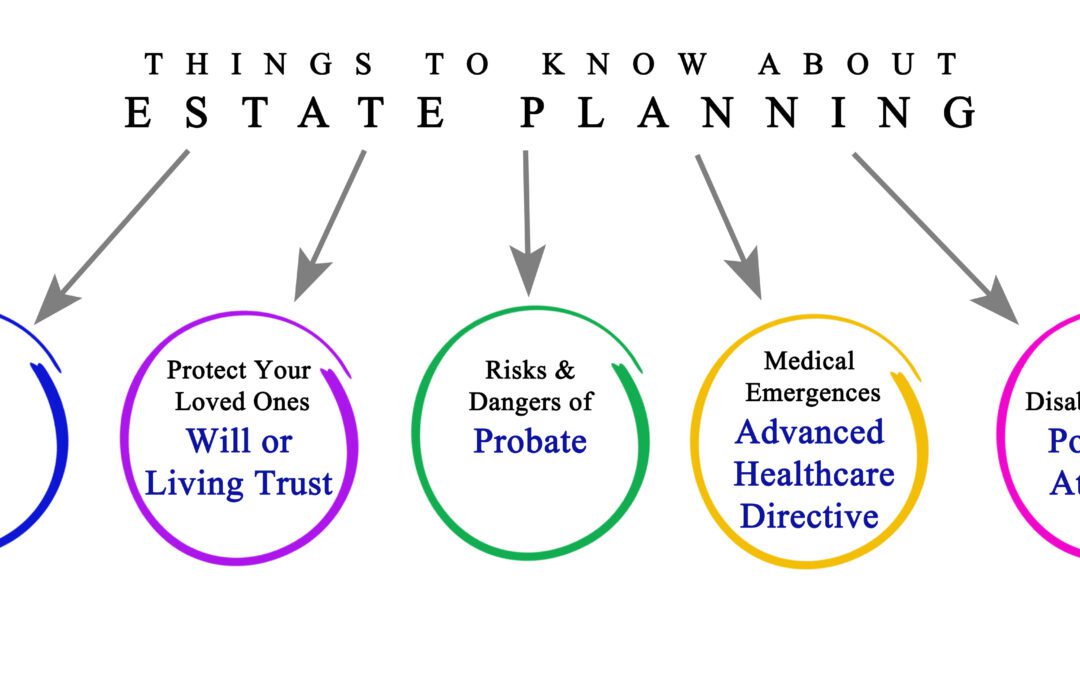

I am here to assist you in modernizing your existing estate plan or developing a new plan that fully protects you and your family.

Francine D. Ward

Attorney-At-Law, Author, Speaker

Follow Francine:

Don’t miss Francine’s Latest Blogs:

- Sweepstakes ScamsSweepstakes Scams. The Federal Trade Commission (FTC) has settled with several operators of a sweepstakes scam. The scam bilked consumers out of millions of dollars. Included in the settlement agreement,… Read more: Sweepstakes Scams

- Incapacity PlanningIncapacity Planning. Incapacity is an unexpected wrinkle in your estate plan. I am a planner. I make plans, I like making plans, and sometimes my plans go awry. Despite any… Read more: Incapacity Planning

- Publishing contractsPublishing contracts The publishing contract is an agreement that defines the relationship between an author and her publisher. Publishing contracts typically contain elements that speak to territory, rights, ownership, financial… Read more: Publishing contracts

- What is a Habit?As we enter springtime, you may feel far away from your New Year’s resolution. That may be because of the success rate of NYE resolutions. In fact, January 17 is… Read more: What is a Habit?

- Common Contract MistakeCommon Contract Mistake #1. Not Having Written Agreements with EVERYONE You Do Business With. Common contract mistake. Without question, the most common contract mistake is not having the terms of… Read more: Common Contract Mistake